PA 168 amends Part 1 of the MITA specifically section 30 1 which defines the individual income tax base to create a new individual income tax deduction for wagering losses sustained by casual gamblers effective for tax years beginning in 2021. états financiers consolidés specified person at any time means a qualifying person that meets the following conditions.

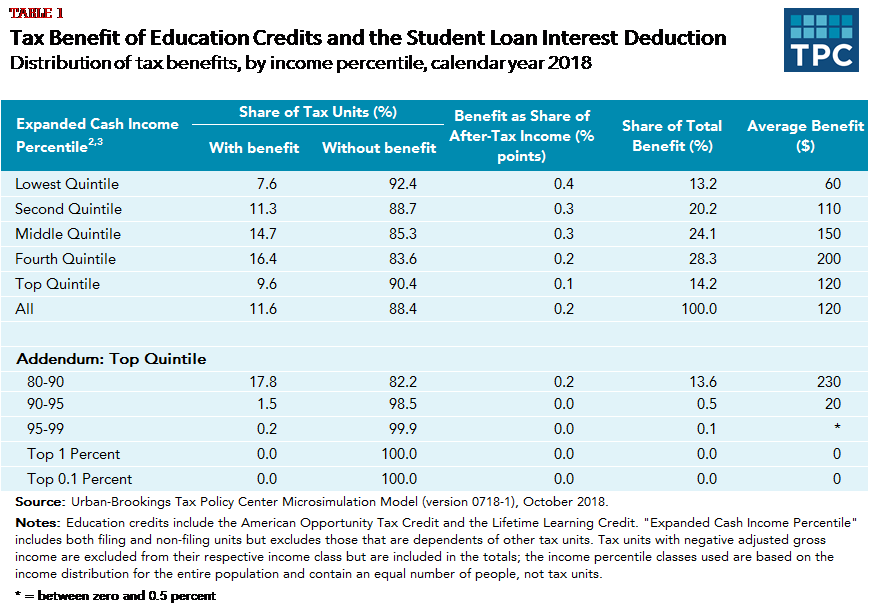

What Tax Incentives Exist For Higher Education Tax Policy Center

110a allows a lessee to exclude from income the amount of a qualified construction allowance received from a landlord to the extent the allowance does not exceed the actual costs incurred to improve the leased space.

. 110 a In General. 110 a 1. For individuals below the age of 60 the maximum amount of deduction under section 80DDB is Rs40000.

That guidance continues to be of relevance up to 1 June 2018. ० मअकर 0 VAT करपट Tax Plate New Tax Codes Applicable from 2075-04-01 Withholding Tax TDS Advance Tax FY 2076-77 Fines and Penalties under Income Tax Act FY 2076-77 Income Tax Rates FY 2076-77 Tax Deduction at Source TDS Rates FY 2075-76 Income Tax Rates FY 2075-76. 1 Section 110 of the principal Act prior to the amendment of that section under this Act shall apply to a person other than an offshore company excluding chargeable offshore company in respect of any tax deducted under this Part.

A the company must be resident in Ireland. Less division c deductions section 110 deductions. Guidance on the amendment to section 110 by Finance Act 2011 was published in Tax Briefing 2 of 2012.

TAX DEDUCTION UNDER SECTION 110 OTHERS No. The purpose of this tax provision is to provide a set of rules for certain construction allowances in which the tax reporting and treatment will be consistent between the lessor and lessee. Amended and updated notes on section 110 of Income Tax Act 1961 as amended by the Finance Act 2020 and Income-tax Rules 1962.

The deduction is equal to the wagering losses claimed by the taxpayer as an. These limits are adjusted for inflation each year. Detail discussion on provisions and rules related to determination of tax where total income includes income on which no tax is payable.

This regime which has been in existence since 1991 is widely used and internationally regarded. Section 110-11-2 - Deduction of Federal Estate Tax 21. 2021 PA 168.

Section 110 deductions - 1101 Deductions permitted For the purpose of computing the taxable income of a taxpayer for a taxation year there may be. Received under a short-term lease of retail space and. Determination of tax where total income includes income on which no tax is payable.

Where there is included in the total income of an assessee any income on which no income-tax is payable under the provisions of this Act the assessee shall be entitled to a deduction from the amount of income-tax with which he is chargeable on his total income of an. Code 110 - Qualified lessee construction allowances for short-term leases. 110 01 The following definitions apply in this section.

Under a short-term lease of retail space and. A company cannot take a Section 179 deduction on more than their total annual taxable income. A qualifying person agreed to sell or issue to the employee shares of its capital stock or the capital stock of another corporation that it does not deal with at arms length or agreed to sell or issue units of a mutual fund trust.

The employee can claim a deduction under paragraph 1101d of the Income Tax Act if all of the following conditions are met. Income tax deduction under this section is allowed for the expenses incurred over treatment of some specific diseases or ailments on self or dependents spouse children parents brothers and sisters. Key conditions of section 110 Section 110 sets out a number of conditions which a company must meet in order to be a qualifying company.

Chapter XII Sections 110 to. Consolidated financial statements has the same meaning as in subsection 2338 1. Provided that that person shall not be entitled to any set-off under that section if.

It allows for organisations to achieve a neutral tax position provided certain conditions are met. Additionally under a qualified Section 110 provision the landlord will be treated as the owner of the constructed improvements and entitled to depreciation deductions as nonresidential real estate. With the respect to decedents dying on or after March 6 1959 where a decedent dies a resident of West Virginia a deduction is allowed for Federal estate tax paid in determining the inheritance tax.

The purpose of the deduction is to bring the effective tax rate on stock option income to. The amendments made by this section enacting this section and amending sections 168 and 6724 of this title shall apply to leases entered into after the date of the enactment of this Act. B if the qualifying person is a member of a group that annually prepares consolidated financial statements the total consolidated.

For tax years beginning 2020 if a business spends more than 2590000 on property the Section 179 deduction will be reduced by that amount. Less Division C deductions Section 110 deductions Charitable donations XXXX from TAX 315 at University of Calgary. 110 allows tenants to exclude from income any amount received in cash as a construction allowance from the owner or treated as a reduction in rent.

This safe-harbor exclusion applies if the allowance is. Total tax deducted under section 110 others. Ain the case where section 40 applies dividend is paid to that person during the period.

Determination of tax where total income includes income on which no tax is payable. Section 110 is at the heart of Irelands structured finance regime. Section 110 of the Income Tax Act.

Qualified Lessee Construction Allowances For Short-Term Leases. Under the final regulations the rules of section 110 will apply to any qualified lessee construction allowance that is any amount received in cash or treated as a rent reduction by a lessee from a lessor under a short-term lease 1 of retail space provided that certain purpose and expenditure requirements are met. Year of Assessment Z 1 10 9 8 7 6 5 4 3 2 TOT AL B.

Less Division C deductions Section 110 deductions Charitable donations XXXX. Gross income of a lessee does not include any amount received in cash or treated as a rent reduction by a lessee from a lessor. Code Name of Payer Gross Tax Deducted Date of Receipt Trust Body Income RM RM sen Payment No.

Section 1101d Deduction Taxpayers w ho have earne d income wit h respect to stoc k options are a llowed to claim a deduction in the same year provided certain conditions are met.

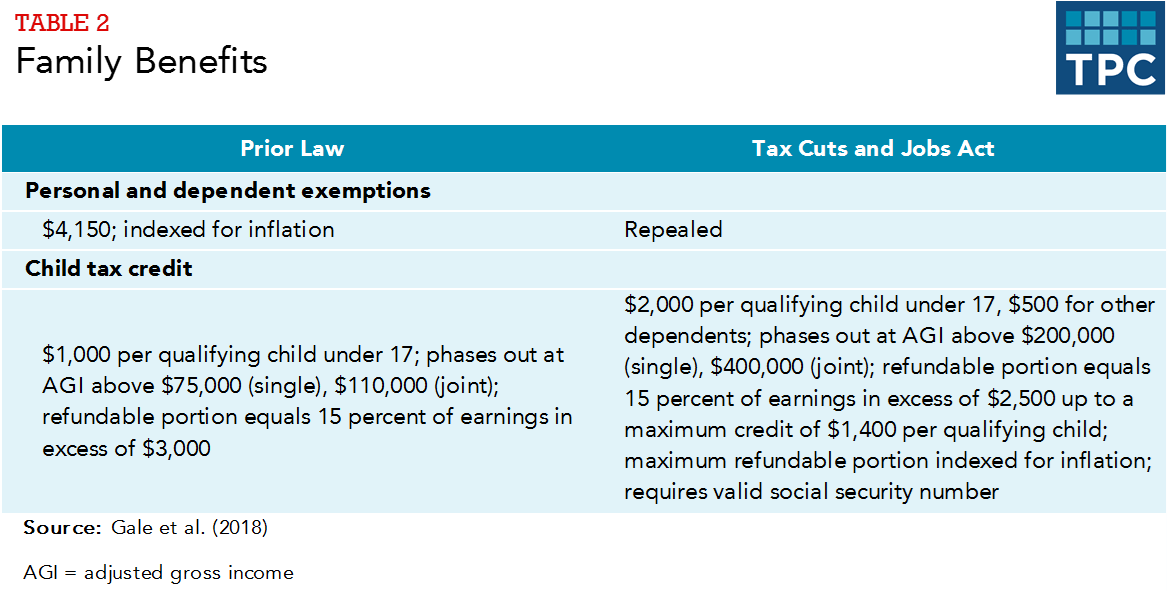

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Postponement Of Ldce For Promotion To The Cadre Of Inspector Of Posts For The Vacancies Of The Year 2019 And 2020 D Communication Department Promotion Post De

Reassessment In Absence Of Fresh Material Indicating Income Escapement Is Invalid Http Taxguru In Income Tax Reassessment In Income Income Tax Indirect Tax

Tax Treatment Of Tenant Allowances Journal Of Accountancy

Who Pays The Most In Taxes Connecticut Debates Inequality And Fairness As Final Approval Of State Budget Is Expected Wednesday Hartford Courant

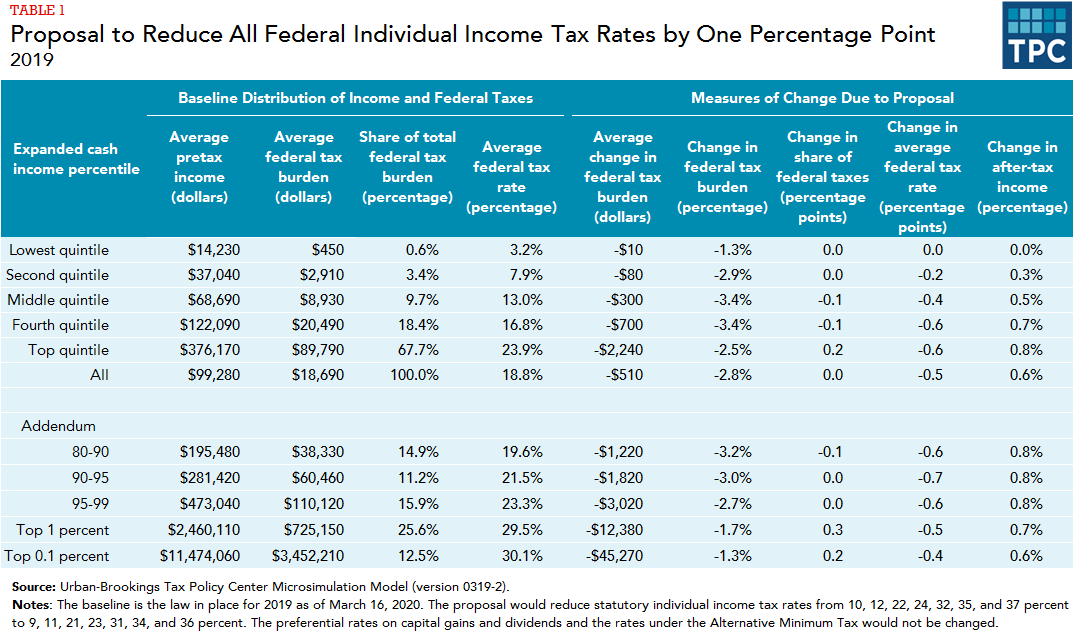

How Should Progressivity Be Measured Tax Policy Center

Earn Your Leisure On Instagram Very Useful Information Today S Study Hall Will Be Out On All Podcast Audio Outlets At 5 Pm Est Podcasts Study Tax Deductions

Re Issuance Of Income Tax Refund How To Submit Request Online Tax Refund Income Tax Filing Taxes

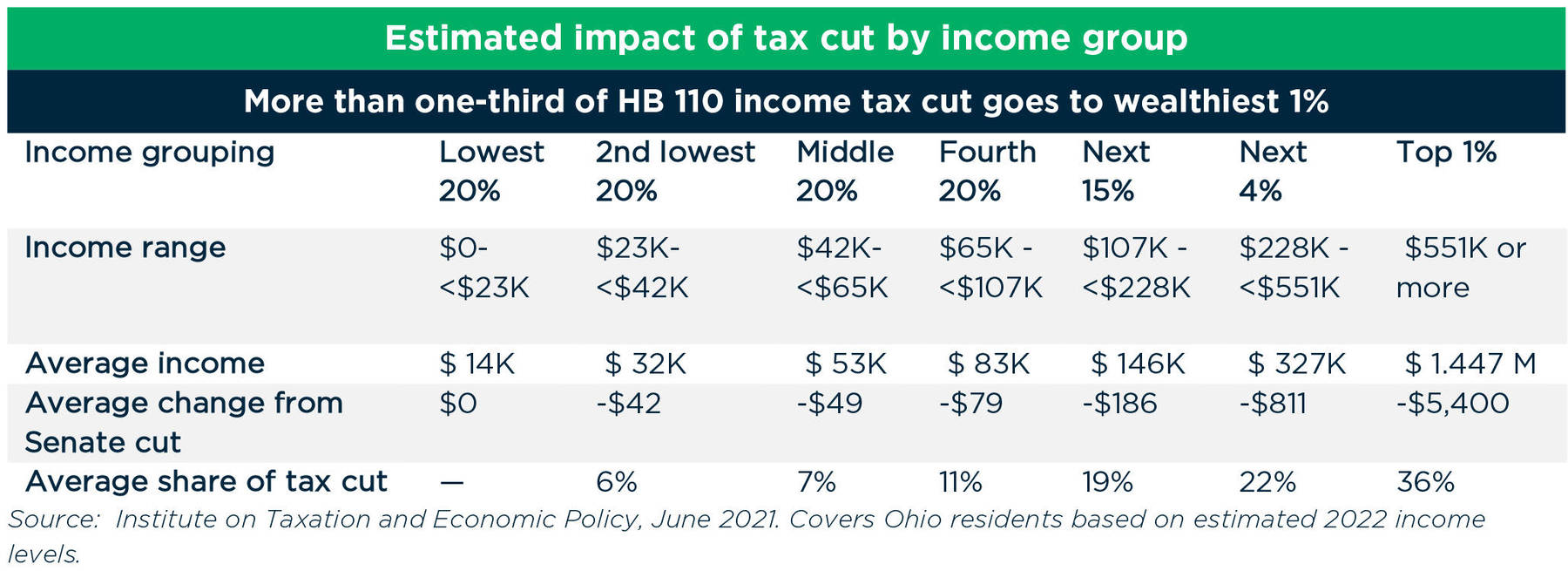

Ohio Tax Cuts Would Go Mostly To The Very Affluent

Strategies For Minimizing Estimated Tax Payments

Can Purchasing A Laser Maximize Your Tax Deductions Yes Here S How

Donate To Charity Donate To Charity Donation Tax Deduction Charity

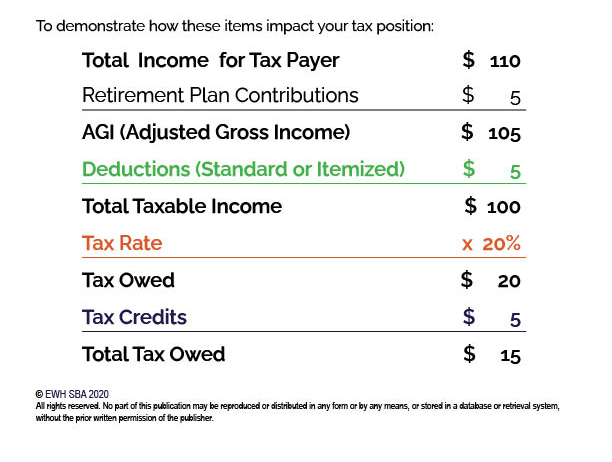

5 Factors That Determine Your Tax Position Ewh Small Business Accounting

Republican Skin In The Game Tax Proposal How Much Would Californians Pay Krcr

Grouping And The Passive Activity Rules Lumpkin Agency Insurance And Financial Services

Missing These Tax Deductions Means Missing Out On Money Tax Deductions Deduction Tax

Goods And Service Tax Gst India A Summary Goods And Services Business Systems Business Tax